Polkadot (DOT) Deep Research

Decoding the Multichain Vision & Market Action

Published on Wednesday, October 1, 2025

Current Price Oct 2025

$3.91

Short-term Rebound

MACD bull crossover · Neutral RSI · ETF news

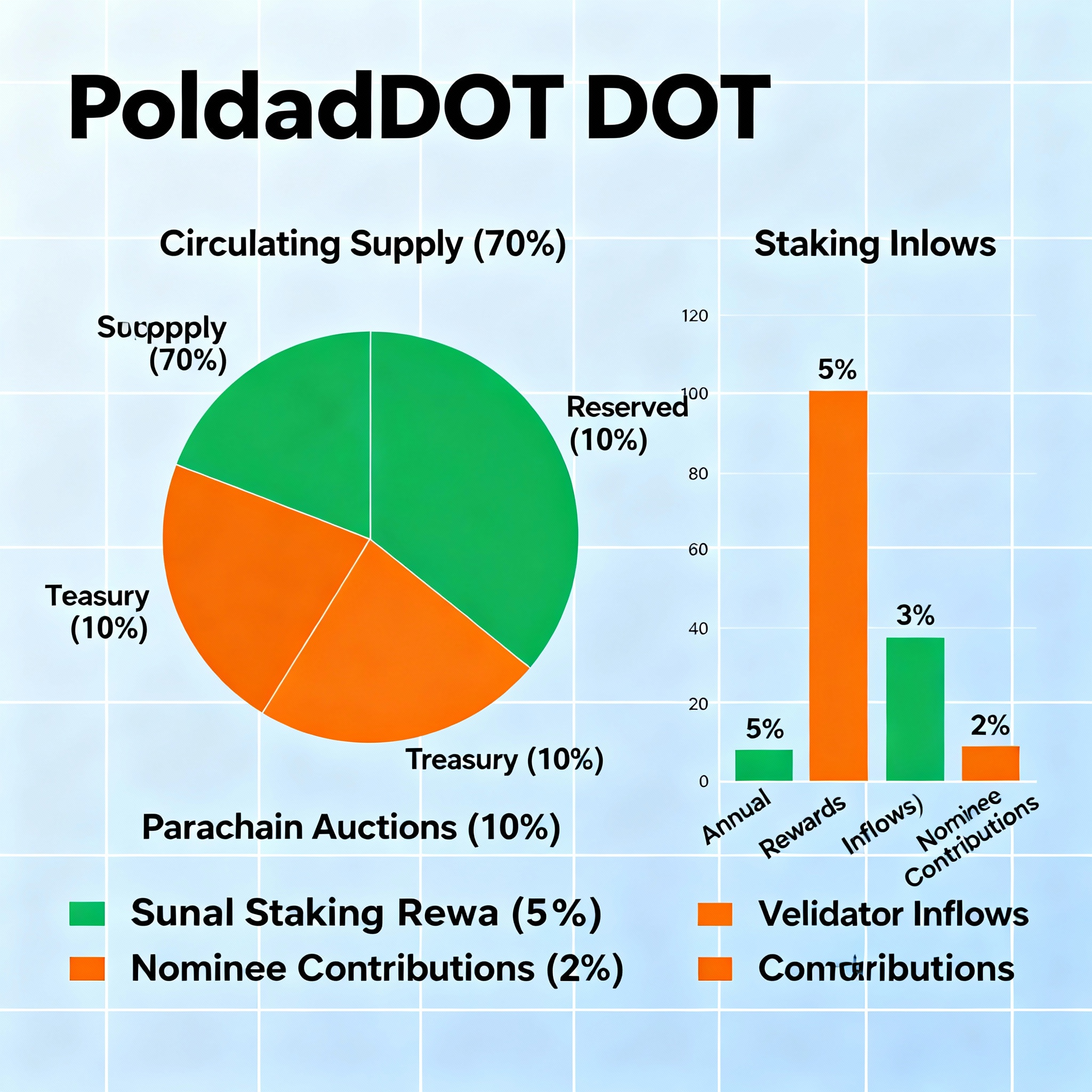

DOT Tokenomics

Permanent supply cap, increased staking, treasury and crowdloan dynamics.

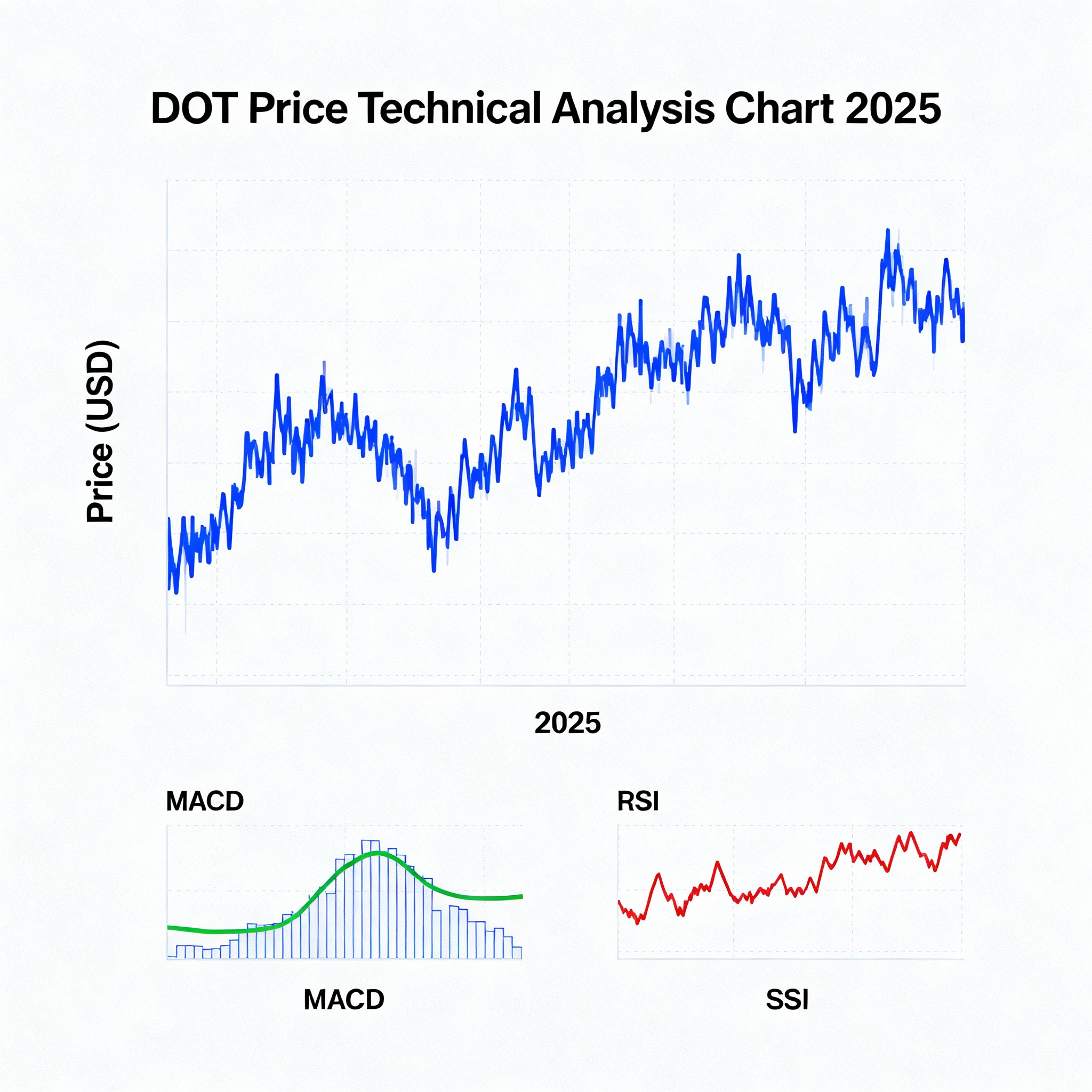

DOT Price & Technicals

MACD bullish crossover, RSI neutral, price rebound off key support.

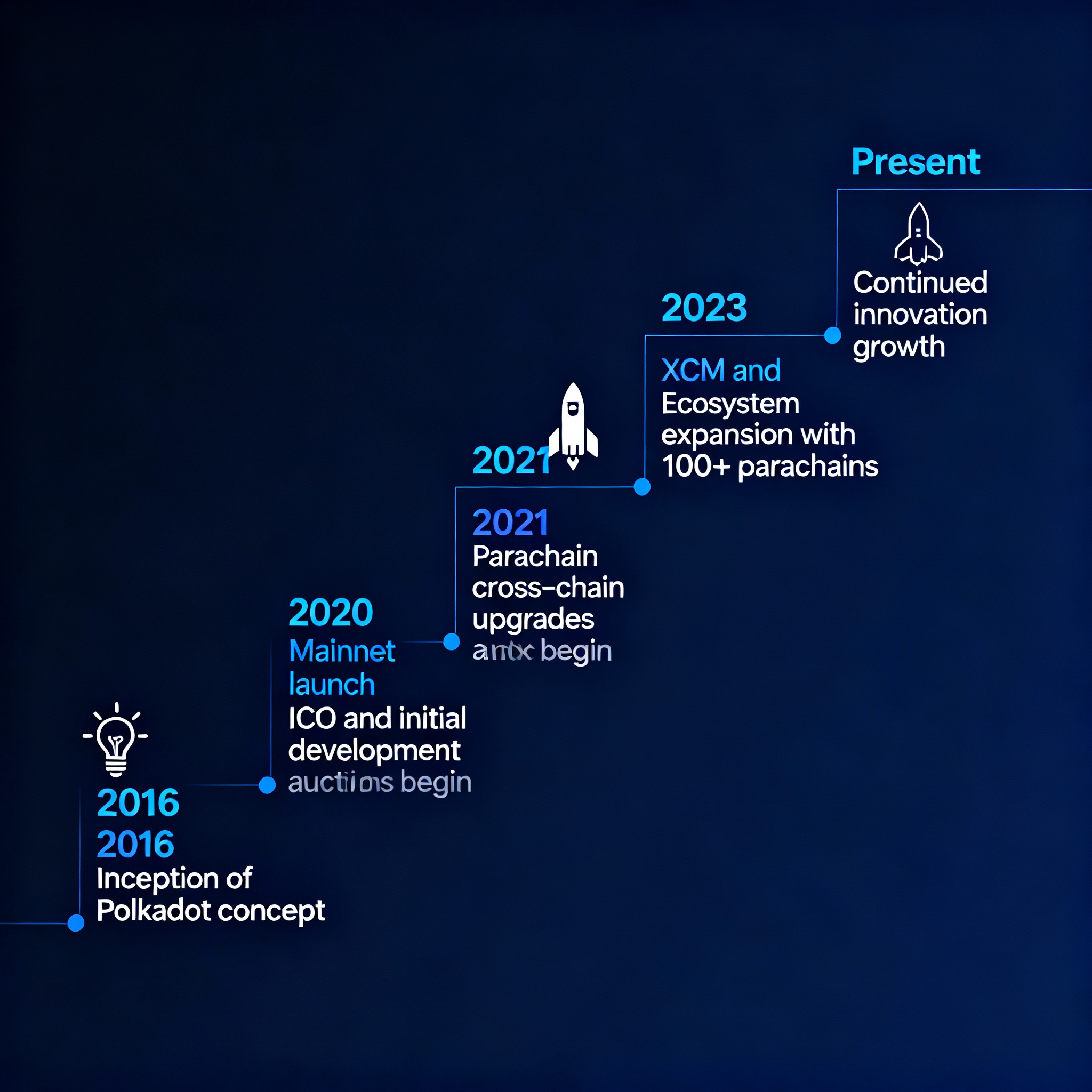

Polkadot Timeline

Key moments: whitepaper, mainnet, parachain, deflationary update.

Key Points

- Overview: Polkadot (DOT) is a blockchain platform designed for interoperability between different blockchains, allowing seamless data and asset transfer. As of October 1, 2025, its native token DOT trades around $3.91, showing short-term recovery signals amid broader market volatility.

- History Highlights: Founded in 2016 by Ethereum co-founder Gavin Wood and others, Polkadot launched its mainnet in 2020 after a successful ICO in 2017 that raised significant funds. It has evolved from a proof-of-authority network to a robust proof-of-stake system, with key upgrades like parachains enhancing its ecosystem.

- Fundamentals: At its core, Polkadot uses a relay chain to connect specialized parachains, enabling scalability and security. DOT serves for governance, staking, and bonding parachains, with over 48% of supply staked, indicating strong holder commitment but also potential supply constraints.

- Technical Signals: Recent charts suggest a bullish MACD crossover and RSI recovery from oversold levels, pointing to possible upward momentum, though persistent selling pressure has led to a 0.63% dip in the last 24 hours. Evidence leans toward a rebound if support holds above $3.81.

- Vision and Roadmap: Polkadot aims for a multi-chain Web3 future with high scalability, targeting 1 million transactions per second via upgrades like JAM (Join-Accumulate Machine) in Q4 2025. This includes cloud-like infrastructure for apps, emphasizing decentralization and interoperability.

- Current News and Sentiment: Institutional interest grows with the 21Shares Polkadot ETF (TDOT) listed on DTCC, signaling potential mainstream adoption, though SEC withdrawals of filings highlight regulatory hurdles. The community proposal for a DOT-backed stablecoin (pUSD) has 75.4% support, boosting liquidity optimism, but risks like algorithmic volatility (recalling TerraUSD) temper enthusiasm. Overall sentiment is mixed: long-term bullish on multi-chain potential, cautious on short-term risks.

Recent Developments

Research suggests Polkadot's ecosystem is expanding, with proposals like pUSD aiming to enhance autonomy and reduce reliance on external stablecoins like USDT. ETF listings on DTCC indicate growing institutional momentum, but not final approval—decisions expected by November 2025. Technical indicators show recovery potential after a dip to $3.815, with MACD signaling bullish shifts. However, regulatory setbacks from SEC withdrawals could delay altcoin ETF approvals, adding uncertainty.

Positives and Opportunities

Evidence points to strong community support for innovations like pUSD, which could improve liquidity and DeFi integration within Polkadot. Bullish technicals and roadmap items like JAM upgrades suggest scalability gains, potentially attracting more developers and users. Institutional steps, such as DTCC listings, may open doors to mainstream exposure.

Risks and Challenges

Regulatory thresholds remain a hurdle, as seen in SEC's withdrawal of 19b-4 filings for Polkadot and other altcoins. Price weakness persists with recent declines, and stablecoin proposals carry volatility risks, especially given past failures like TerraUSD. Broader market sentiment is mixed, with optimism for long-term potential balanced against short-term selling pressure.

Community Outlook

Discussions reflect optimism about Polkadot's role in a multi-chain future, with 75.4% backing pUSD despite concerns over algorithmic risks. Sentiment leans positive long-term, acknowledging complexities like regulatory and volatility issues, while emphasizing empathy for diverse stakeholder views in governance.

Detailed History of Polkadot

Polkadot's journey began in 2016, spearheaded by Gavin Wood, a co-founder of Ethereum who coined the term "Web3," alongside Peter Czaban and Robert Habermeier. The project's whitepaper, released that year, outlined a vision for a heterogeneous multi-chain framework to enable secure communication between independent blockchains. This addressed limitations in isolated networks like Bitcoin and Ethereum, proposing a relay chain to coordinate parachains—specialized blockchains that plug into the main network for shared security.

In 2017, Polkadot conducted a successful initial coin offering (ICO), raising substantial funds to fuel development. The project was managed by the Web3 Foundation, a non-profit dedicated to decentralized web technologies. Early phases operated under a proof-of-authority model, transitioning to proof-of-stake with nominated validators in 2019.

The mainnet launched on May 26, 2020, as a proof-of-stake network, marking a key milestone where validators began securing transactions. DOT, the native token, debuted in August 2020, enabling governance and staking. By mid-2021, parachain auctions commenced, allowing projects to lease slots on the relay chain. Polkadot's price peaked at around $53 in November 2021 amid the broader crypto bull market, but it faced declines during the 2022 bear market, trading below $10 until a partial recovery in 2024.

In 2025, Polkadot implemented significant upgrades, including a 2.1 billion DOT supply cap approved by community vote, aiming to curb inflation and enhance tokenomics. This followed governance reforms and treasury optimizations, reflecting the project's evolution toward greater decentralization. Historical price trends show volatility: from a low of $3.23 in June 2025 to current levels around $3.91, influenced by market cycles and ecosystem growth.

| Year | Key Milestone | DOT Price Range (USD) | Market Impact |

|---|---|---|---|

| 2016 | Whitepaper release and founding | N/A (pre-launch) | Laid foundation for multi-chain vision |

| 2017 | ICO raises funds | N/A | Attracted early investors |

| 2020 | Mainnet launch and DOT debut | $2.70 - $6.00 | Initial adoption surge |

| 2021 | Parachain auctions begin | Up to $53 | Bull market peak |

| 2022-2023 | Bear market adjustments | $4.00 - $10.00 | Ecosystem consolidation |

| 2024-2025 | Supply cap and upgrades | $3.23 - $4.50 | Focus on deflationary mechanics and scalability |

Fundamental Analysis

Polkadot's fundamentals revolve around its sharded multi-chain architecture, which differentiates it from monolithic blockchains. The relay chain acts as the central hub, providing shared security and consensus via Nominated Proof-of-Stake (NPoS). Parachains, up to 100 in capacity, handle specific functions like DeFi or NFTs, connected via cross-chain message passing (XCMP).

DOT's utility is multifaceted: it facilitates governance through on-chain voting, staking for network security (with over 48% of supply staked), and bonding to secure parachain slots. This creates deflationary pressure, as staked tokens reduce circulating supply. The ecosystem includes over 50 parachains, such as Acala for DeFi and Moonbeam for EVM compatibility, fostering a vibrant developer community.

Economically, Polkadot's treasury, funded by transaction fees and inflation, supports grants and proposals. Recent reforms aim for stricter spending to ensure sustainability. Fundamentals rebounded in 2025 with ecosystem funds like Scytale Digital adding value. However, competition from rivals like Cosmos or Ethereum layer-2s poses challenges, though Polkadot's focus on seamless interoperability gives it an edge in a multi-chain world.

| Fundamental Aspect | Description | Strength/Weakness |

|---|---|---|

| Network Architecture | Relay chain + parachains for scalability | Strong: Enables 1M+ TPS potential; Weak: Complex for new users |

| Token Utility | Governance, staking, bonding | Strong: High staking ratio (48%+); Weak: Inflation concerns pre-cap |

| Ecosystem Size | 50+ parachains, 1,000+ validators | Strong: Diverse applications; Weak: Adoption lags behind Ethereum |

| Security Model | Shared security via NPoS | Strong: Robust against attacks; Weak: Centralization risks in validators |

Technical Analysis (as of Oct 1, 2025)

DOT trades at ~$3.91, down 0.63% in last 24h but showing potential recovery. Price dipped to $3.815 before rebounding; tested support at $3.81 amid bearish pressure. Indicators:

- MACD (12,26): 0.006, bullish crossover indicating upward momentum.

- RSI (14): 45.263, neutral recovering from oversold.

- STOCH RSI (14): 0, oversold, signaling buying opportunity.

- ADX (14): 34.951, sell signal, weakening trend strength.

- 24h Price Change: -0.63%, mild decline but under rebound watch.

Long-term, DOT is negotiating a falling trend channel, approaching breakout from broadening wedge. Resistance levels at $4.01, $4.48, $5.07; support at $3.62. Volume and volatility suggest reload phase, with 2025 price forecasts from $4.01 lows to $13.90 highs.

Vision and Roadmap

Polkadot aims to serve as a scalable, secure Web3 infrastructure where diverse blockchains operate in a unified ecosystem using a relay chain and parachain design. The 2025 roadmap includes tokenomics reforms, governance upgrades, and scaling solutions targeting 1 million TPS via the Join-Accumulate Machine (JAM) rollout in Q4 2025.

Polkadot 2.0 features Agile Coretime and Elastic Scaling to efficiently allocate resources on demand. Future Cloud 3.0 enhancements focus on Ethereum-style improvements and broad multi-chain integration. Community education efforts and developer tools bolster decentralization and ecosystem growth.

Present News and Developments

- 21Shares Polkadot ETF (TDOT) listed on DTCC as a pre-launch institutional gateway; SEC approvals pending with decisions expected November 2025.

- SEC recently withdrew 19b-4 filings for DOT and other cryptocurrencies citing regulatory standards, creating approval uncertainties.

- Community pUSD stablecoin proposal backed by DOT (built on Acala Honzon protocol) enjoys 75.4% approval with substantial DOT staked.

- Concerns over algorithmic stablecoins’ historic volatility temper enthusiasm for pUSD despite optimism for ecosystem liquidity boost.

- Other developments include Polygon interoperability integrations and Bifrost achieving 20M DOT locked assets.

| Recent News Item | Date | Impact |

|---|---|---|

| TDOT ETF on DTCC | Oct 1, 2025 | Positive: Institutional momentum |

| pUSD Proposal Vote | Sep 2025 | Positive: 75.4% support; Risk: Algorithmic concerns |

| SEC Filing Withdrawals | Sep 2025 | Negative: Regulatory delay |

| JAM Upgrade Scheduled | Q4 2025 | Positive: Scalability boost |

| Supply Cap Approved | Sep 2025 | Positive: Deflationary pressure |

Risks and Challenges

- Regulatory delays on ETF approvals may hinder institutional entry and market confidence.

- Price volatility and continued selling pressure place near-term stress on DOT value.

- Algorithmic stablecoins like pUSD risk repeating past volatility failures such as TerraUSD.

- Competition from Ethereum layer-2s, Cosmos, and emerging chains remains intense.

Community Outlook

The Polkadot community remains optimistic about the platform's multi-chain future role. Despite concerns about algorithmic stablecoins, the pUSD proposal garnered 75.4% support reflecting strong engagement. Sentiment balances excitement over long-term value with wariness of short-term regulatory and volatility challenges.