Crypto Proxy Stocks: The Strategic Investment Report for 2025

Published on July 27, 2025 | Market Analysis

Executive Summary

Crypto proxy stocks have emerged as a compelling investment avenue for traditional investors seeking exposure to the digital asset revolution without directly owning cryptocurrencies. These stocks represent companies whose business models are intrinsically linked to Bitcoin and other digital currencies, offering a regulated pathway to participate in crypto's growth potential.

In 2025, the crypto proxy market has reached unprecedented maturity, with several key players demonstrating remarkable growth trajectories. From Bitcoin treasury companies like MicroStrategy to mining operations like Riot Platforms, these stocks provide diversified exposure to the expanding digital asset ecosystem.

Key Infographics

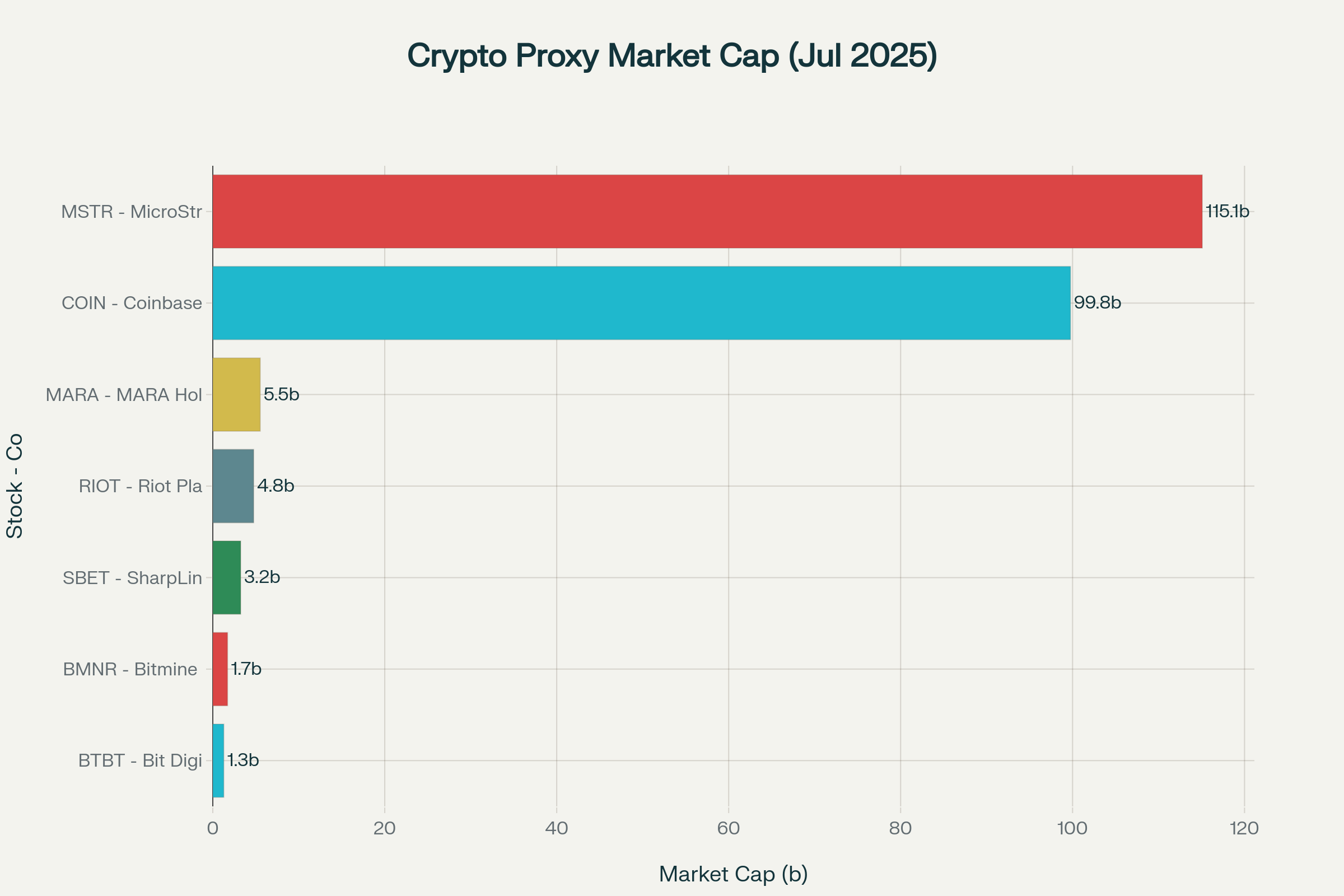

Market Capitalization of Leading Crypto Proxy Stocks (July 2025)

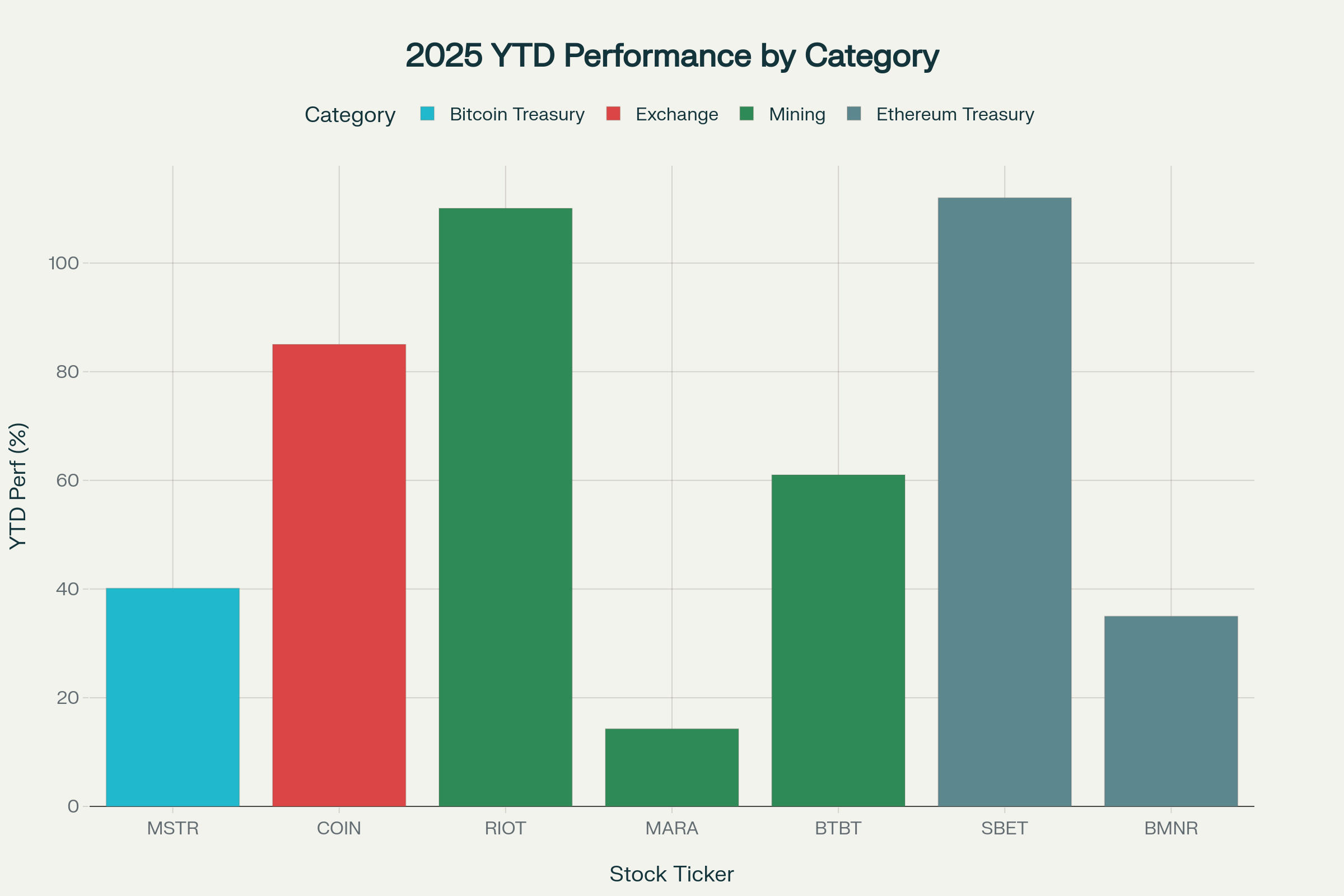

2025 YTD Performance by Category

Detailed Report

Market Overview: The 2025 Crypto Proxy Landscape

The crypto proxy sector has experienced significant expansion in 2025, driven by institutional adoption and regulatory clarity. Bitcoin treasury companies are becoming a dominant force, with more corporations adding Bitcoin to their balance sheets as a treasury asset. This trend has created a new category of investment opportunities that bridge traditional finance and digital assets.

Key Market Dynamics

- Institutional adoption acceleration: Major corporations increasingly view Bitcoin as a legitimate treasury asset.

- Regulatory environment stabilization: Clearer guidelines have reduced investment uncertainty.

- Mining industry consolidation: Larger, more efficient operations are dominating the landscape.

- Exchange platform expansion: Global reach and institutional services driving growth.

Stock Highlights Summary

| Ticker | Company | Market Cap (B USD) | Category | 2025 YTD Performance (%) |

|---|---|---|---|---|

| MSTR | MicroStrategy | $115.09 | Bitcoin Treasury | +40.15% |

| COIN | Coinbase Global | $99.76 | Exchange | +85.02% |

| RIOT | Riot Platforms | $4.76 | Mining | +110.06% |

| MARA | MARA Holdings | $5.52 | Mining | +14.27% |

| SBET | SharpLink Gaming | $3.25 | Ethereum Treasury | +112.00% |

| BMNR | Bitmine Immersion | $1.72 | Ethereum Treasury | +35.00% |

| BTBT | Bit Digital | $1.28 | Mining | +61.00% |

Top Crypto Proxy Stocks Analysis

Market Position: MicroStrategy stands as the undisputed leader in corporate Bitcoin holdings, essentially functioning as a Bitcoin ETF in disguise.

Key Metrics:

- Market Cap: $115.31 billion

- EPS: -$21.81 (negative due to Bitcoin accounting)

- Recent Performance: 255.5% growth over the past year

Investment Thesis: MSTR offers the purest play on Bitcoin price appreciation through traditional stock markets. The company's strategy of converting cash flows into Bitcoin creates a leveraged exposure to cryptocurrency movements. Analysts predict the stock could reach $2,413 by 2025, representing significant upside potential.

Risk Factors: High volatility mirrors Bitcoin's price swings, and regulatory changes affecting Bitcoin could impact the stock substantially.

Market Position: Riot Platforms has established itself as a premier Bitcoin mining operation with significant operational improvements in 2025.

Key Metrics:

- Market Cap: $4.76 billion

- Revenue: $458.75 million (TTM)

- Q1 2025 Revenue: $161.4 million (13% increase)

- EPS: -$1.36

Investment Thesis: The company completed a strategic $185 million acquisition of Rhodium's operations, enhancing power capacity and eliminating hosting losses. With a 7% increase in self-mining hash rate to 33.7 exahash, RIOT demonstrates operational excellence. Analysts project a potential upside of over 110% with an average price target of $16.32.

Risk Factors: Energy costs, regulatory changes, and Bitcoin price volatility directly impact profitability.

Market Position: SBET represents the intersection of sports betting and blockchain technology, targeting the growing online gambling market.

Key Metrics:

- Market Cap: $3.25 billion

- Revenue: $3.43 million (TTM)

- EPS: -$8.97

- Beta: 12.10 (extremely high volatility)

Investment Thesis: The company operates performance marketing platforms for sportsbooks and casinos, with increasing integration of cryptocurrency elements. The convergence of sports betting and crypto presents significant growth opportunities, particularly as tokenized wagering gains acceptance.

Risk Factors: Extreme volatility (Beta 12.10) makes this suitable only for risk-tolerant investors. Regulatory challenges in gaming and crypto sectors pose additional risks.

Market Position: BMNR focuses on advanced immersion cooling technology for Bitcoin mining operations.

Key Metrics:

- Market Cap: $1.72 billion

- Revenue: $5.45 million (TTM), up 413% from previous year

- EPS: -$2.89

- Volatility: 215.9% average weekly movement

Investment Thesis: The company's thermodynamic management systems represent cutting-edge mining technology. As mining competition intensifies, efficiency advantages become crucial for profitability. The dramatic revenue growth demonstrates market traction for their solutions.

Risk Factors: Extremely high volatility and continued losses present significant risks. The company operates in a highly competitive and rapidly evolving sector.

Market Position: BTBT combines Bitcoin mining with sustainable energy practices and AI-related crypto technologies.

Key Metrics:

- Market Cap: $1.28 billion

- Revenue: $102.04 million (TTM)

- EPS: -$0.51

- Analyst Rating: Strong Buy with $6.33 target

Investment Thesis: The company's focus on sustainable mining positions it favorably as environmental concerns grow. The integration of AI technologies provides additional growth avenues beyond traditional mining operations.

Risk Factors: High beta (5.26) indicates significant volatility, and the company continues to report losses despite revenue growth.

Market Position: MARA operates one of the world's largest Bitcoin mining operations with ambitious expansion plans.

Key Metrics:

- Market Cap: $5.52 billion

- Q1 2025 Revenue: $213.9 million (30% increase YoY)

- Bitcoin Holdings: 26,747 BTC in reserves

- Target Hash Rate: 75 EH/s by end of 2025

Investment Thesis: MARA's vertically integrated model and substantial power capacity (1.7 GW captive, 1.1 GW operational) provide competitive advantages. The company's growth pipeline exceeds 3 GW of low-cost power opportunities.

Risk Factors: Despite revenue growth, the company reported a net loss of $533.2 million in Q1 2025, primarily due to high operating expenses.

Market Position: Coinbase dominates the crypto trading industry with global reach and institutional focus.

Key Metrics:

- Market Cap: $52.6 billion

- Expected 2025 Revenue: $5.98 billion (23.7% growth)

- Q1 2025 Results: $1.64 billion revenue, $4.40 EPS

- User Base: Over 130 million across 100+ countries

Investment Thesis: Record trading volumes exceeding $1.5 trillion by December 2024, combined with institutional partnerships and global expansion, position COIN as the infrastructure play for crypto adoption.

Risk Factors: Regulatory shifts could impact profitability, and the business remains sensitive to crypto market volatility.

Investment Strategies & Risk Management

When investing in crypto proxy stocks, diversification across different business models is crucial. Consider allocating investments across treasury companies, miners, and exchanges to balance exposure. Portfolio allocation should reflect risk tolerance, with more conservative investors focusing on established players like MicroStrategy and Coinbase.

Risk management strategies should include position sizing based on volatility metrics, regular rebalancing, and stop-loss orders for highly volatile positions. Monitor regulatory developments closely, as policy changes can significantly impact sector performance.

Market Outlook

The outlook for crypto proxy stocks remains optimistic through 2025, driven by continued institutional adoption and improving regulatory clarity. Bitcoin treasury companies are expected to benefit from corporate adoption trends, while mining operations should see consolidation and efficiency improvements.

Key catalysts to watch include Bitcoin ETF developments, regulatory frameworks in major markets, and institutional custody solutions. These factors will likely drive continued growth in the sector.

Conclusion & Recommendations

Crypto proxy stocks offer a compelling investment opportunity for 2025, providing regulated exposure to the digital asset revolution. While volatility remains a key consideration, the sector's maturation and regulatory clarity present attractive risk-adjusted returns.

Recommended investment approach: Start with core positions in established players (MSTR, COIN), add mining exposure through diversified holdings (RIOT, MARA), and consider smaller speculative positions in innovation plays (BMNR, BTBT) based on risk tolerance.

Disclaimer

This report is for informational purposes only and does not constitute financial advice. Crypto proxy stocks are highly volatile investments that may not be suitable for all investors. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making investment decisions. All data is current as of July 27, 2025, and subject to change.